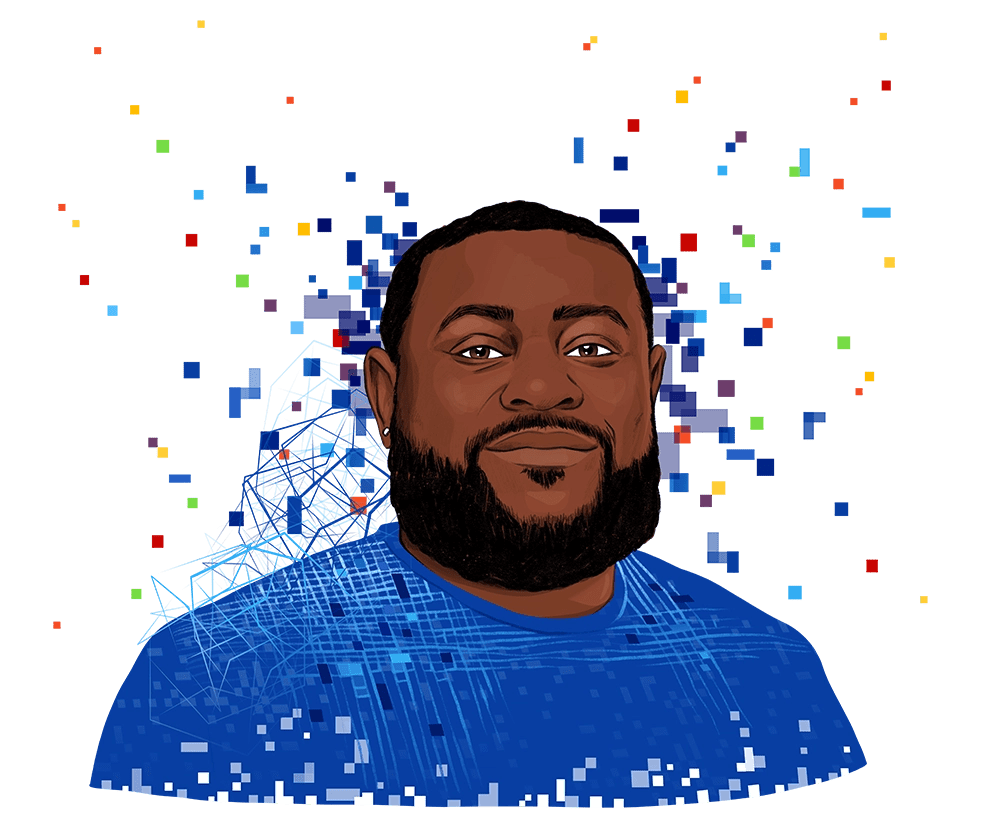

Black Tech Talent: Creating A More Diverse Workforce Through Culturally Relevant Offerings

Mike Jackson sits on a throne during Zoom meetings.

The chair has a maroon back and golden stiles, creating a pleasant distraction in the oft-drab world of virtual conversations. But given Jackson’s recent success, the seat is also a fitting mirror of his ascent in the start-up realm.

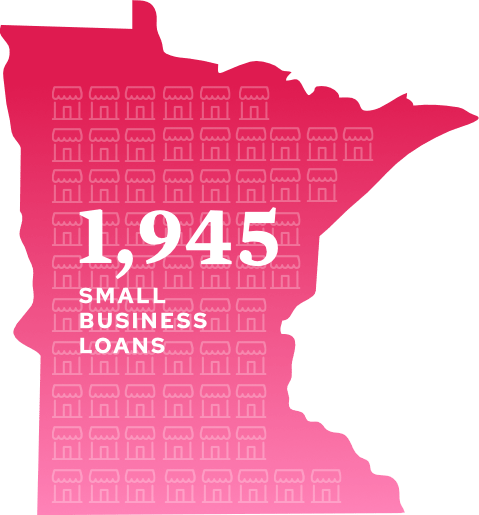

Jackson’s new company, Black Tech Talent, has won multiple awards and gained more than 4,000 members since it launched in July 2020. The company’s small-but-mighty team has landed contracts with some of the biggest employers in the Twin Cities, including Target and Health Partners.

“We’re making tech cool in the Black community,” says Jackson.

Black Tech Talent’s main goal is to create more diversity in the technology field. The company offers a job board and culturally specific content catered to Black workers interested in entering tech as well as training and recruiting services. Black workers make up only 3% of the roughly 200,000 people working in the tech sector locally, according to CompTIA. Jackson adds that of around 900,000 unfilled IT positions, just 4-7% go to Black applicants.

Why do these disparities exist? There are multiple reasons, according to Jackson. But mainly, he says, the problem stems from unconscious bias.

“A lot of these tech companies… they start off with two or three white guys,” says Jackson. “It becomes a referral system in the early stages where everybody looks alike, sounds alike and thinks alike. White people are more willing to take a chance on unqualified white people than they are to take a chance on a qualified Black person.”

As a founder and CEO, Jackson himself is an anomaly: Only 3% of executive positions are held by Black employees at companies with more than 100 workers in the United States. Just 1% of venture-funded startup founders are Black.

Black Tech Talent relies heavily on content marketing to promote the business, including a podcast that Jackson hosts. Jackson engages in long, deep conversations with his guests, focusing on everything from redlining to DevOps. He invites Black professionals on the show to speak to their work experiences and how to support the Black community. This content, he says, is what sets the business apart.

“It’s like being a fly on the wall during genuine Black conversations,” says Jackson of the podcast. “I discuss the different journeys that different Black technologists have, the good and the bad.”

More than anything, the business represents a step in generating more wealth in the Black community. Data from 2019 states Black households had just 12% the wealth of white households. In addition, in Minnesota, just 24% of Black households own their home compared to 77% of white households.

Jackson saw an opportunity to fight these disparities when he started Black Tech Talent. His background as an entrepreneur gives him an advantage, he says.

“Looking at the landscape, I was like this is an opportunity to build a business that can genuinely help the Black community elevate economically through tech,” says Jackson.

And so far, he’s off to a great start. Jackson’s business received the Inclusive Evolution Award as part of Twin Cities Startup Week and Twin Cities Business Magazine’s Community Impact Award. Jackson has also been named a 40 under 40 honoree by the Minneapolis/St. Paul Business Journal.

Aside from generating wealth in the Black community and getting more people of color into technology positions, Jackson’s endeavor gives the BIPOC community a voice in a sector that too often leaves them behind.

Take, for example, facial recognition. Jackson points out that because the algorithms used to deploy facial recognition technology disproportionately use data from white faces, they produce inaccurate readings for Black people and create the potential for illegitimate arrests and charges. The recent film Coded Bias looks at this very issue.

“If it ever gets to a point where they’re testing AI and facial recognition software to specifically identify and lock up Black people, it’s not accurate,” says Jackson.

Jackson has had a research firm reach out to him to get more people of color involved in algorithm testing. It’s this kind of work, he says, that sets Black Tech Talent apart and will allow it to make an impact going forward.

“We don’t want to be looked at as just a staffing company or a recruiting company. We’re conducting our own research… we’re building new technology within our company and we’re having different conversations on how we can change things,” says Jackson.

Certified B Corporations located across

Certified B Corporations located across  countries and

countries and  industries.

industries.

customers, holds up to $200 billion of combined assets under management, and is supported by more than 80,000 coworkers.

customers, holds up to $200 billion of combined assets under management, and is supported by more than 80,000 coworkers.